Corporate Governance

- Basic Corporate Governance Principles

- Corporate Governance System

- Nomination of Officers

- Compensation of Officers

- Actions to Ensure Board Effectiveness

- Responding to Large-Scale Acquisitions of Seiko Epson Shares

To realize our Purpose, which expresses our aim or reason for being in society based on the Epson Way, which defines our values and behaviors based on the Management Philosophy, EXCEED YOUR VISION, promote sustainable growth, and increase corporate value over the medium and long term, Seiko Epson Corporation ("the Company") strives to continuously enhance and strengthen corporate governance so as to realize transparent, fair, fast, and decisive decision-making.

In order to further increase the effectiveness of corporate governance, the Company further improves the supervisory function of the Board of Directors, further enhances deliberation and speeds up management decision-making.

Basic Corporate Governance Principles

The general principles of corporate governance at the Company are as follows:

- Respect the rights of shareholders, and secure equality.

- Bear in mind the interests of, and cooperate with, stakeholders, including shareholders, customers, local communities, business partners, and Epson personnel.

- Appropriately disclose company information and maintain transparency.

- Directors, Executive Officers, and Special Audit & Supervisory Officers shall be aware of their fiduciary duties and shall fulfill the roles and responsibilities expected of them.

- Engage in constructive dialogue with shareholders.

Corporate Governance System

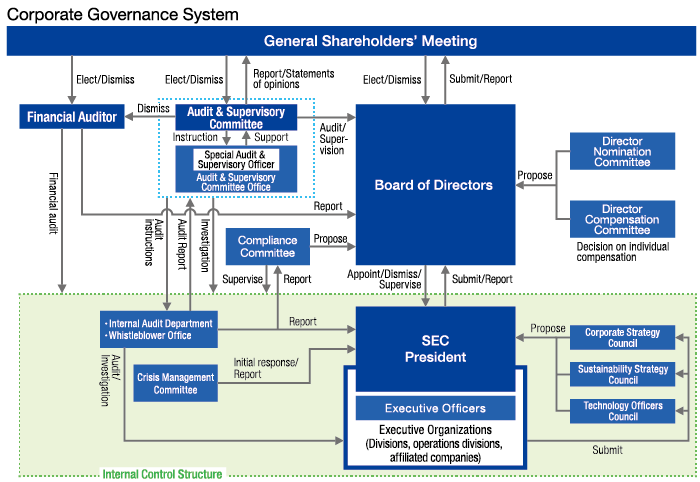

The Company is structured as a company with an Audit & Supervisory Committee. It has a Board of Directors, an Audit & Supervisory Committee, and a financial auditor. It has also voluntarily established advisory committees for matters such as the Director nomination and compensation.

This governance system was adopted to further increase the effectiveness of corporate governance by strengthening supervision over management and by enabling the Board of Directors to devote more time to discussions while speeding up decision-making by management.

The main bodies and their aims are described below.

Board of Directors

The Board of Directors, with a mandate from shareholders, is responsible for realizing efficient and effective corporate governance, through which the Company will accomplish its social mission, sustain growth, and maximize corporate value over the medium and long terms. To fulfill these responsibilities, the Board of Directors will exercise a supervisory function over general management affairs, maintain management fairness and transparency, and make important business decisions, including decisions on things such as management plans, business plans, and investments exceeding a certain amount.

The Board of Directors operates in accordance with the Articles of Incorporation and regulations that were approved by resolution of the Board of Directors. The Board of Directors is composed of 11 directors1, including six Outside Directors. Meetings of the Board of Directors are, as a rule, held once per month and as needed. The Chairman and Director, who serves as a non-executive director, acts as the chairman of the Board meetings. Corporate Governance Policy states that at least one-third of the board members should be Outside Directors.

The Board of Directors makes decisions on basic business policies, important business affairs, and other matters that the Board of Directors is responsible for deciding as provided for in internal regulations. Business affairs that the Board of Directors is not responsible for deciding are delegated to executive management, and the Board monitors these. To speed up management decisions and increase business agility as a company with an Audit & Supervisory Committee, the Company has expanded the scope of affairs delegated to executive management from the Board of Directors, including capital investments below a certain threshold. Board meetings were held 13 times in the 2024 fiscal year and two times during the period from April 2025 to the June 2025 Ordinary General Meeting of Shareholders. The attendance rate for each director is 100%.

1 As of June 30, 2025

Audit & Supervisory Committee

The Audit & Supervisory Committee, with a mandate from shareholders, is responsible for independently and objectively auditing and monitoring the execution of Director duties and for ensuring the sound and sustained growth of the Company. The Audit & Supervisory Committee verifies the effectiveness of the internal control system and conducts audits primarily in cooperation with internal audit departments and the financial auditor. The Audit & Supervisory Committee has established basic guidelines for selecting financial auditors and evaluates their independence, audit quality, etc. based on certain standards. Resolutions concerning financial auditors selected by the Committee per the guidelines are submitted for approval at a general meeting of shareholders. The Audit & Supervisory Committee also discusses the selection, dismissal, resignation, and compensation of Directors who are not Audit & Supervisory Committee members and decides on the opinions to be presented at a general meeting of shareholders.

The Audit & Supervisory Committee operates in accordance with the regulations that were approved by resolution of the Audit & Supervisory Committee. The Audit & Supervisory Committee is composed of four Audit & Supervisory Committee members2, three of whom are Outside Directors. It is chaired by a full-time member of the Audit & Supervisory Committee. Meetings are generally held once per month and as needed.

2 As of June 30, 2025

Compliance Committee

The Compliance Committee’s function is to discuss the content of reports that it receives concerning important compliance activities, and report its findings and communicate its opinions to the Board of Directors in order to see that compliance activities are appropriately executed by line management.

The Compliance Committee operates in accordance with the regulations that were approved by resolution of the Board of Directors. As an advisory body to the Board of Directors, the Compliance Committee is composed of Outside Directors and Directors who are Audit & Supervisory Committee members. The Compliance Committee is chaired by a full-time member of the Audit & Supervisory Committee. Meetings are held every half year and as needed. Financial auditors and the head of the internal audit control departments attend meetings of the Committee as observers.

A Chief Compliance Officer (CCO) is elected by the Board of Directors and supervises and monitors compliance-related affairs on the whole. The CCO periodically reports the state of compliance affairs to the Compliance Committee.

Director Nomination Committee & Director Compensation Committee

The Company has established the Director Nomination Committee and the Director Compensation Committee as voluntary deliberation bodies, and they are chaired by an Outside Director, and the majority of committee members are Outside Directors. These Committees are designed to ensure transparency and objectivity in the screening and nomination of candidates for Director, Executive Officer, and Special Audit & Supervisory Officer and in matters of Director compensation. The Human Resources Department serves as the secretariat for these deliberation committees. These Committees operate in accordance with the regulations that were approved by resolution of the Board of Directors.

The overview of each of these Committees is as follows:

Composition

Both the Director Nomination Committee and the Director Compensation Committee are composed of all Outside Directors, President and Representative Director, and the Outside Directors shall select the committee chairs from among themselves. Directors who are full-time members of the Audit & Supervisory Committee can attend meetings of either Committee as observers.

The current3 members are as follows:

[The Director Nomination Committee]

Chairman: Outside Director, Tadashi Shimamoto

Members: Outside Directors, Masaki Yamauchi, Kahori Miyake, Susumu Murakoshi, Michiko Ohtsuka, Akira Marumoto, and Junkichi Yoshida, President

[The Director Compensation Committee]

Chairman: Outside Director, Masaki Yamauchi

Members: Outside Directors, Tadashi Shimamoto, Kahori Miyake, Susumu Murakoshi, Michiko Ohtsuka, Akira Marumoto, and Junkichi Yoshida, President

3 As of June 30, 2025

The Mandates, Roles, and Activities of the Director Nomination Committee

The Company has established a Director Nomination Committee as an optional deliberative body to impartially examine through a transparent and objective process the selection of Director candidates and the dismissal of Directors as well as to evaluate and supervise the status of Director successor development plans created by the President and Representative Director, the issues therein, and Director succession plans created by the President and Representative Director.

The Committee met 13 times in the 2024 fiscal year and two times during the period from April 2025 to the June 2025 Ordinary General Meeting of Shareholders. The Committee deliberated on matters including succession plans for the President and Representative Director, policies for selecting Officers (Directors, Executive Officers and Special Audit & Supervisory Officers) . With respect to the change of the President and Representative Director dated April 1, 2025, the Director Nomination Committee confirmed the progress of the succession plan for the President and Representative Director, nominated the candidates and reported them to the Board of Directors.

The Mandates, Roles, and Activities of the Director Compensation Committee

The Company has established a Director Compensation Committee as an optional deliberative body to impartially examine through a transparent and objective process proposals and discussions concerning matters such as the compensation system and bylaws for Directors of the Company as well as Directors' individual compensation. The Director Compensation Committee, with a mandate from the Board of Directors, decides the individual compensation of Directors who are not Audit & Supervisory Committee members.

The Committee met seven times in the 2024 fiscal year and three times during the period from April 2025 to the June 2025 Ordinary General Meeting of Shareholders. The Committee deliberated on matters including the amount of base compensation for each Director, bonus payment coefficient and amount for each Director, coefficient allocated, number of shares to be allocated and amount of monetary compensation claims under the restricted stock compensation plan, renewal of directors and officers liability insurance, and conclusion of a company indemnity agreement and a liability limitation contract, procedures related to the settlement of the performance-linked stock compensation (officer compensation BIP trust) under the previous system, etc.

Committee attendance

The attendance rate of each member of the Director Nomination Committee and Director Compensation Committee during the 2024 fiscal year and during the period from April 2025 to the June 2025 Ordinary General Meeting of Shareholders was as follows.

Director Nomination Committee: 100% for both the 2024 fiscal year and the period from April 2025 to the June 2025 Ordinary General Meeting of Shareholders

Director Compensation Committee: 75% (three out of four meetings) for the 2024 fiscal year for Mari Matsunaga, and 100% for the others; 100% for the period from April 2025 to the June 2025 Ordinary General Meeting of Shareholders

Corporate Strategy Council

The Corporate Strategy Council is an advisory body to the President whose purpose is to help ensure that the right decisions are made based on a range of opinions on the executive management side. Meetings of the Corporate Strategy Council are where Directors, each business and General Administrative Managers, etc. exhaustively examine important business topics that affect the Epson Group as a whole and matters on the agenda for meetings of the Board of Directors. The Corporate Strategy Council is basically held every two weeks. Outside Directors can attend this meeting, but even if they cannot attend, they are provided with materials for the topics discussed and supplementary explanations of what was discussed. The Company strives to ensure the fairness and transparency of the execution of business affairs through the attendance of a Director who is a Full-Time Audit & Supervisory Committee member and Special Audit & Supervisory Officer.

Nomination of Officers

The policies and procedures for nominating Director candidates and for selecting and dismissing Executive Officers (including the President) and Special Audit & Supervisory Officers are as follows:

Policies

- Considering the role that Officers of the Company are required to fulfill and the nomination criteria that Epson has established, Officers must meet the standard requirements of insight, accountability, and ethics. They must also satisfy the selection criteria in 2, depending on their respective roles, and must be able to contribute to an increase in corporate value.

- In addition to the foregoing requirements, Officers of the Company shall satisfy the selection criteria below.

- Non-Executive Director candidates

Oversight capability, management knowledge, professional knowledge - Executive Director candidates

Oversight capability, foresight/insight, the ability to conceive a vision, decisiveness/courage, the ability to execute and produce results, an inclination to drive change and innovation, the ability to be a unifying force

A candidate for President and Representative Director in particular shall possess the following:

- The ability to face societal issues, construct a vision based on deep insight, and the courage to carry out that vision

- A strong sense of ethics and the ability to humbly accept diverse values, tap the initiative of employees, and be a unifying force that consolidates the power of the entire company - Executive Officers

Foresight/insight, the ability to conceive a vision, decisiveness/courage, the ability to execute and produce results, an inclination to drive change and innovation, the ability to be a unifying force - Special Audit & Supervisory Officer

The ability to influence and lead the Company, creativity, the ability to drive change, management ability, the ability to lead a group, management knowledge, professional knowledge

- Non-Executive Director candidates

- Outside Directors must satisfy criteria concerning the independence of Outside Directors in order to guarantee their independence. The Board of Directors established "Criteria for Independence of Outside Directors."

* As a general rule, Outside Directors shall not concurrently serve as either a Director or a Kansayaku of more than three publicly listed companies other than the Company per the bylaws established by resolution of the Board of Directors.

* Per the Company policy, Directors shall attend at least 75% of the meetings of the Board of Directors per year.

Procedures

Nomination, selection, and dismissal are decided by the Board of Directors after a fair, transparent, and rigorous screening by the Director Nomination Committee, which also presents its opinion. The consent of the Audit & Supervisory Committee is required for nominating Director candidates who are Audit & Supervisory Committee members and for appointing Special Audit & Supervisory Officers.

Criteria for Independence of Outside Directors

The Company has established the criteria below to objectively determine whether potential Outside Directors are independent.

- A person is not independent if:

- The person considers the Company to be a major business partner1, or has served as an executive2 within the past five years in an entity for which the Company is a major business partner;

- The person is a major business partner3 of the Company or has served as an executive within the past five years in an entity that is a major business partner of the Company.

- The person is a business consultant, certified public accountant, or lawyer who has received a large sum of money or other forms of compensation4 (other than remuneration as an officer) from the Company or has, within the past three years, performed duties equivalent to those of an executive as an employee of a corporation or group, such as a union, that has received a large sum of money or other forms of compensation from the Company;

- The person is a major shareholder5 of the Company or has, within the past five years, been an executive or Audit & Supervisory Board Member of an entity that is a major shareholder of the Company;

- The person is an executive or Audit & Supervisory Board Member of an entity in which the Company is currently a major shareholder;

- The person is a major lender6 to the Company or has been an executive of a major lender to the Company within the past five years;

- The person has been employed by an auditing firm that has conducted a legal accounting audit of the Company within the past five years;

- The person has been employed by a leading managing underwriter of the Company within the past five years;

- The person has received a large donation7 from the Company or, within the past three years, has performed duties equivalent to those of an executive as an employee of a corporation or a group, such as a union, that has received a large donation from the Company;

- The person came from an entity with a relationship of reciprocal employment of Outside Director8; or

- A spouse or relative within the second degree of kinship of a person having the interests listed in (Ⅰ) through (Ⅸ) above.

- Even if any of the foregoing criteria apply to a potential Outside Director, the Company can elect that person as an Outside Director if that person satisfies the requirements for Outside Directors set forth in the Companies Act, and the Company deems the person suitable as an Outside Director of the Company in light of his or her personality, knowledge, experience, or other qualifications upon explaining and announcing the reasons thereof.

Notes

- A person (usually a supplier) considers the Company to be a major business partner if 2% or more of its consolidated net sales (consolidated revenue) has come from the Company in any fiscal year within the past three years.

- "Executive" means an executive officer, executive director or operating officer, or an employee occupying a senior management position of department manager or higher.

- A person (usually a buyer) is a major business partner if 2% or more of the Company's consolidated revenue has come from that partner in any fiscal year within the past three years.

- "A large sum of money or other forms of compensation" means an average annual amount for the past three years that is:

- no less than 10 million yen for an individual; or

- no less than 2% of the annual revenues in any fiscal year for a group.

- "Major shareholder" means a shareholder who directly or indirectly holds 10% or more of the voting rights.

- "A major lender" means a financial institution or other major creditor that is indispensable for the Company's financing and on which the Company depends to the extent that it is irreplaceable in any fiscal year within the past three years.

- "Large donation" means a donation whose annual average amount for the past three years exceeds either:

- 10 million yen or

- 30% of the annual expense of the group, whichever is higher.

- “Reciprocal employment of Outside Director” means accepting an Outside Director from an entity that currently employs someone from the Company as an Outside Director.

Reason for Appointed as Outside Directors

| Name | Reason for Appointment |

|---|---|

|

Tadashi Shimamoto |

Mr. Shimamoto has served as President, Member of the Board and Chairman, Member of the Board of Nomura Research Institute, Ltd. and has a wealth of experience and insight as a corporate manager and in fundamental technology, distribution, service, and industry-related systems. The Company believes that he, as an Outside Director of the Company, will monitor corporate management appropriately, aiming at achieving sustainable growth and improving the Company’s corporate value over the medium- to long-term through his active opinions and proposals from the perspective of overall management and DX/IT systems, based on his familiarity with corporate management in the information service industry, which is a different business field. |

|

Masaki Yamauchi |

Mr. Yamauchi has served as President and Chairperson of the Board of Directors of Yamato Holdings Co., Ltd. and has a wealth of insight and experience in corporate management. The Company believes that, based on his experience in practicing satisfaction-creating management that makes full use of digital technology, his efforts to instill Yamato’s DNA (values) in employees and his track record of fostering organizational culture, he will monitor corporate management appropriately, aiming at achieving sustainable growth and improving the Company’s corporate value over the medium- to long-term through his active opinions and proposals from the perspectives of organizational management, DX/IT, and sustainability that relate to the fundamentals of corporate management. |

|

Kahori Miyake |

Ms. Miyake promoted ESG strategies as Executive Officer of AEON Co., Ltd. and is currently a Fellow Officer of Sumitomo Mitsui Trust Bank, Limited and Co-Chair of the Japan Climate Leaders’ Partnership, a cross-industry group of companies working to achieve a sustainable, decarbonized society. The Company believes that, based on her wealth of experience and considerable insight into ESG and decarbonization measures, she will monitor corporate management appropriately, aiming at our goal of achieving sustainability and enriching communities and improving the Company’s corporate value over the medium- to long-term through her active opinions and proposals from the perspective of environmental management with expertise in environmental and social contribution. |

|

Susumu Murakoshi |

Mr. Murakoshi has a high level of expertise as an attorney. Having served as the President of Japan Federation of Bar Associations and the President of Japan Attorneys Political Association, he has a wealth of experience in the legal community. The Company believes that he will continuously contribute to monitoring management appropriately to achieve sustained growth and increase medium- to long-term corporate value, as well to ensure soundness of the management. He has never been involved in corporate management except as an outside officer. However, given the reasons above, the Company believes that he can appropriately perform his duties as an Outside Director who is an Audit & Supervisory Committee member. |

|

Michiko Ohtsuka |

Ms. Ohtsuka has a high level of expertise as a certified public accountant. She has a considerable insight and experience as an independent officer of a listed company. The Company believes that she will continuously contribute to monitoring management appropriately to achieve sustained growth and increase medium- to long-term corporate value, as well to ensure soundness of the management. She has never been involved in corporate management except as an outside officer. However, given the reasons above, the Company believes that she can appropriately perform her duties as an Outside Director who is an Audit & Supervisory Committee member. |

|

Akira Marumoto |

Mr. Marumoto has served as Executive Vice President and President of Mazda Motor Corporation and has a wealth of experience and considerable insight in corporate management. He was in charge of a wide range of administrative areas, including corporate planning, production and sales operations in the U.S., general affairs, public relations, and human resources. After assuming the position of president, he responded to various management issues and, as one example, strengthened earning power by improving profitability through dealership reforms and putting a new plant into operation. The Company believes that he will be able to appropriately supervise and contribute to the soundness of the Company's management aimed at achieving sustainable growth and improving the Company's corporate value over the medium- to long-term. |

Approach to Selecting Directors

The Company believes that a diverse Board of Directors is useful for facilitating substantive board discussions that cover all angles. Therefore, our basic policy is to maintain a board that is well-balanced and composed of persons who combine a broad spectrum of knowledge, experience, and skill in their respective areas of expertise, without regard to gender, race, ethnicity, country of origin, nationality, cultural background, age, etc.

Matrix of Areas of Expertise Particularly Expected for Directors (Skill Matrix)

By clarifying the specific areas of expectation for our directors, Epson has established a management system toward achieving the Corporate Purpose and Corporate Vision based on the Management Philosophy.

|

Title |

Name |

Areas of expertise and skills particularly expected by the Company |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Corporate Management |

Development Design Business Development |

Sales Marketing |

IT Digital |

Finance Accounting Investment |

Compliance Governance |

HR Development HR Management |

Environment Sustainability |

Global (Internationality) |

||

| Chairman and Director |

Yasunori Ogawa |

|

|

|

||||||

| President and Representative Director |

Junkichi Yoshida |

|

|

|

||||||

| Director Executive Officer |

Yasunori Yoshino |

|

|

|

||||||

| Director Executive Officer |

Akihiro Fukaishi |

|

|

|

||||||

| Outside Director |

Tadashi Shimamoto |

|

|

|

||||||

| Outside Director |

Masaki Yamauchi |

|

|

|

||||||

| Outside Director |

Kahori Miyake |

|

|

|

||||||

|

Director Full-Time Audit & Supervisory Committee Member |

Masayuki Kawana |

|

|

|

||||||

|

Outside Director Audit & Supervisory Committee Member |

Susumu Murakoshi |

|

|

|

||||||

|

Outside Director Audit & Supervisory Committee Member |

Michiko Ohtsuka |

|

|

|

||||||

|

Outside Director Audit & Supervisory Committee Member |

Akira Marumoto |

|

|

|

||||||

* Up to three areas of expertise particularly expected are stated.

* As of June 30, 2025.

Compensation of Officers

The policies and procedures related to officer compensation are as follows:

Policies

Compensation for executive officers

- Compensation shall provide an incentive to improve business performance and reflect the commitment thereof in order to promote the Epson Group’s sustainable growth and corporate value in the medium and long term.

- Compensation shall be sufficient to attract and retain qualified persons both from within the Company and from outside.

- Compensation shall be commensurate with period performance so that directors and executive officers can demonstrate their management capabilities to the fullest during their tenure.

- Compensation shall clearly reflect the linkage between officer compensation and the value of the Company’s shares and strengthen awareness of the need to share profits with shareholders.

- A mechanism to suppress fraud shall be embedded.

- The process for determining compensation shall be highly transparent, objective, and fair.

Compensation for non-executive officers

- The composition of compensation shall guarantee independence so that these Officers can suitably exert their general management supervisory function, etc.

- Compensation shall be sufficient to attract and retain qualified persons both from within the Company and from outside.

Procedures

With the aim of ensuring transparency and objectivity, compensation of officers is determined through resolutions at the General Meeting of Shareholders and the Board of Directors’ meeting for Directors who are not Audit & Supervisory Committee members, or through resolutions at the General Meeting of Shareholders and discussions by Audit & Supervisory Committee members for Directors who are Audit & Supervisory Committee members, after going through fair, transparent and rigorous reporting by the Director Compensation Committee. With regard to compensation of the Directors who are not Audit & Supervisory Committee members, the Audit & Supervisory Committee shares and discusses what have been examined by the Director Compensation Committee to confirm whether there are special items to be stated at the General Meeting of Shareholders. Matters related to the compensation, including the individual amounts, of the Directors who are not Audit & Supervisory Committee members are left to the discretion of the Director Compensation Committee.

Compensation Structure

The Company’s officer compensation shall consist of base compensation, which is comprised of fixed compensation, bonuses, which is performance-linked compensation, and stock compensation, which is non-monetary compensation. Given their roles to monitor the management as a whole as well as their independence from the business affairs, the Company pays only base compensation to non-executive officers and therefore does not pay bonuses and stock compensation.

Base Compensation (Fixed)

Base compensation is a monetary compensation that is determined in accordance with the position and the magnitude of roles including the contents of operations commissioned and delegated (“Role Grade”). It is paid monthly during the terms of office. Depending on the operating performance of the company and other reasons, the Board of Directors may take measures to increase or decrease the amount.

Performance-Linked Compensation (Bonuses)

Bonus is an annually paid variable performance-linked compensation for officers with executive duties that is determined by the achievement level of the annual operating performance targets and personal goals. In consideration of the nature of bonuses as a short-term incentive, the amount of annual company-wide ROE among others is set as a performance indicator, taking into account factors such as the achievement level of personal goals.

The amount of bonuses payable is calculated by multiplying the annual total compensation calculated based on position and Role Grade by the ratio of bonus (25% to 30%) by position and Role Grade to derive the base bonus amount, and taking the base bonus amount and multiplying it by a coefficient (0% to 200%) corresponding to the achievement level against the company-wide ROE target and other performance indicators and a coefficient (±40%) corresponding to the achievement level of personal goals.

Restricted Stock Compensation (Non-Monetary)

The restricted stock compensation is a stock compensation aimed at further promoting sharing of value with shareholders and providing officers with a greater incentive than before to increase the stock price, sustain growth, and increase medium- to long-term corporate value. It is paid to Directors with executive duties once a year.

Pursuant to the resolution of the Board of Directors of the Company, the Company will pay monetary compensation claims up to the aforesaid annual amount of 200 million yen as compensation, etc., for restricted stock. In turn, eligible Directors will pay all monetary compensation claims provided by the Company as in-kind contributions and will receive an allotment of restricted stock. The aforesaid monetary compensation claims will be paid on condition that eligible Directors have agreed to the aforesaid in-kind contributions and have concluded a restricted stock allotment agreement. The total number of restricted stock shares to be allotted to eligible Directors will not exceed 200,000 shares in each fiscal year.

The restricted stock allotment agreement will include the following:

- Nature of restrictions on transfer

Eligible Directors shall not transfer, pledge, grant security interests, gift during their lifetime, or bequeath, to any third party, or otherwise dispose of restricted stock (hereafter "the Allotted Stock") during the period from the date of allotment to the date on which they resign or retire from their position as either a Director, Executive Officer, or employee of the Company. - Gratis acquisition of restricted stock

If an eligible Director resigns or retires from his or her position as a Director, Executive Officer or employee of the Company before the end of the period, the Company will rightfully acquire the Allotted Stock without compensation, unless there are extenuating circumstances that the Company's Board of Directors deem reasonable. - Lifting of the transfer restrictions

The Company will lift transfer restrictions for all the Allotted Stock upon the end of the final day of the transfer restriction period, provided that the eligible Director holds the position of Director, Executive Officer or employee of the Company continuously from the date the transfer restriction period starts to the date of the first Ordinary General Meeting of Shareholders thereafter. - Malus and clawback provisions

The Company will establish provisions to acquire without contribution some or all of the Allotted Stock granted to eligible Directors or common shares of the Company for which transfer restrictions have been lifted, or to be paid an amount equivalent to the value of the Allotted Stock or common shares of the Company for which transfer restrictions have been lifted, in cases in which the Board of Directors recognizes that eligible Directors have violated laws, regulations, or internal rules, etc. in any material respect during the transfer restriction period or after the lifting of the transfer restrictions, and when certain circumstances determined by the Board of Directors have occurred, including serious accounting irregularities or large losses, etc. - Treatment in organizational restructuring, etc.

If, during the transfer restriction period, matters concerning organizational restructuring, etc., of the Company are approved at an Ordinary General Meeting of Shareholders, the Company will, by resolution of the Board of Directors, lift the transfer restrictions prior to the effective date of the organizational restructuring, etc., for the number of Allotted Stock that is reasonably determined based on the period from the date the transfer restriction period starts to the date the organizational restructuring, etc., is approved.

*The Company plans to also allote restricted stock like the restricted stock described above to Executive Officers who are not Directors of the Company.

To share the benefits and risks of changes in the stock price with general shareholders and to enhance the incentive to increase the stock price, sustain growth, and increase medium- to long-term corporate value, the achievement levels against the indicators including the company-wide ROIC and sustainability goals are set as indicators.

The number of shares to be allotted during the target period is calculated by multiplying the amount of annual total compensation calculated based on the position and Role Grade of each Director by the ratio of stock compensation (20% to 25%) commensurate with position and Role Grade by the coefficient (80% to 120% for each) corresponding to the achievement levels against the indicators including the company-wide ROIC and sustainability goals to derive the base compensation amount, and dividing the base compensation amount by the value of restricted stock per share determined by the Board of Director.

The amount of monetary compensation claim paid to each Director as compensation, etc. concerning restricted stock is calculated by multiplying the number of shares to be allotted by the closing price of the common stock of the Company on the Tokyo Stock Exchange on the business day immediately preceding the date of the Board of Directors’ resolution regarding the issuance or disposal.

Compensation to Directors (FY2024)

| Category

|

Total compensation (millions of yen)

|

Total compensation by type (millions of yen) |

Number of |

|||

|---|---|---|---|---|---|---|

| Base compensation | Performance- linked compensation |

Restricted stock compensation |

Bonuses for retiring executives |

|||

|

Fixed |

Bonus |

|||||

|

Directors who are not Audit & Supervisory Committee members (amount accounted for by Outside Directors) |

266 (44) |

162 (44) |

39 (-) |

40 (-) |

24 (-) |

10 (4) |

|

Directors who are Audit & Supervisory Committee members (amount accounted for by Outside Directors) |

81 (48) |

81 (48) |

- (-) |

- (-) |

- (-) |

5 (4) |

|

Total |

348 | 244 | 39 | 40 | 24 | 15 |

Notes

- The Company has introduced an officers' shareholding association system to link compensation more closely to shareholders' value. A portion of the base compensation is discretionally allotted for the acquisition of the Company's shares. The Company has established the criteria for shareholding by its officers based on internal regulations defined by the Board of Directors to demonstrate its commitment to and responsibilities for the management to all shareholders.

- The amount above includes bonuses to be paid to Directors in the amount of 39 million yen (amount paid to four Directors excluding Outside Directors and Directors who are Audit & Supervisory Committee members), as resolved at the Ordinary General Meeting of Shareholders held on June 26, 2025.

- The bonuses for retiring executives above were paid to one eligible Director who retired at the conclusion of the Ordinary General Meeting of Shareholders held on June 25, 2024 based on a resolution at the Ordinary General Meeting of Shareholders held on June 23, 2006 to abolish bonuses for retiring executives.

- Stock options are not granted.

Actions to Ensure Board Effectiveness

The Board of Directors of the Company analyzes and evaluates the effectiveness of the entire Board of Directors every year based on Article 19 of the Corporate Governance Policy.

Annual Cycle for Evaluating the Effectiveness of the Board of Directors (General Principles)

- When evaluation is planned: November to February

- When evaluation is performed: February to March

- When evaluation results are analyzed and issues are selected: April to May

- Disclosure of issues in a Corporate Governance Report: June

- Summary of progress on actions taken to resolve issues: April to May of the following year.

- Disclosure of the results of actions taken to resolve issues in a Corporate Governance Report: June of the following year

Board of Directors Effectiveness Evaluation for the 2023 Fiscal Year

The results of actions taken to address issues that were raised when the effectiveness of the Board of Directors was evaluated for the 2023 fiscal year are provided below. The effectiveness of the Board of Directors in the 2023 fiscal year was evaluated by having all Board members complete a questionnaire. The questionnaire results showed that the Board of Directors is functioning effectively. (To incorporate a more objective perspective, the effectiveness evaluation was conducted based on the evaluation and opinions of a third-party organization in a series of steps from the preparation of the questionnaire to its analysis and evaluation.)

- Discussion and oversight of response to Epson 25 Renewed financial targets and strategy implementation efforts

The Board primarily discussed and oversaw businesses identified as growth areas. Every quarter, it also discussed and supervised action items aimed at securing earnings from a short- to medium-term perspective. - Holding and acceleration of discussions on long-term corporate strategy

Using an arrangement that allows for free discussion among Board members from the early stages of key management topic exploration, the Board members discussed analyses of the internal and external business environments, as well as preliminary strategic proposals developed by the executive team. In addition, opportunities were provided outside of Board meetings for the heads of the businesses to explain the fundamental structure and medium- to long-term direction of their businesses to the Outside Directors. This helped to build a shared understanding of strategies, challenges, and risks among the Board members, thereby laying the groundwork for future discussions on long-term strategy. - Human capital management initiatives linked to management strategy

At Board meetings, Board members shared issues related to the vision for human capital management and talent strategy and discussed and monitored initiatives in human capital management.

The issues concerned medium- and long-term corporate strategies that are being executed or studied. The Board of Directors will continue to supervise and discuss these issues during the 2025 fiscal year.

Board of Directors effectiveness evaluation for the 2024 fiscal year

Board effectiveness in the 2024 fiscal year was evaluated by having all Board members complete a questionnaire that covered the topics below, and then analyzing and evaluating effectiveness based on the answers. For certain items, executive officers and others who attend Board meetings were asked to complete a questionnaire that was then analyzed to determine whether there were any significant gaps in understanding between the Board of Directors and the executives responsible for business execution.

- Composition of the Board of Directors and how it is positioned

- Operation of the Board of Directors

- Board of Directors discussions and functions

- Directors' activities

- Training

- Dialogue with shareholders (investors)

- Functions and operations of advisory bodies to the Board (the Director Nomination Committee, Director Compensation Committee, and Compliance Committee)

- Summary

The results of the evaluation showed that the Board of Directors as a whole is generally functioning effectively. However, after discussions at a meeting of the Board and after also taking into consideration the results of the 2023 fiscal year Board effectiveness evaluation, the Board identified the issues below in order to improve effectiveness in the future.

- Support for deepening strategic discussions and strengthening execution capabilities of the executive management team

- Oversight of the progress of deliberations on the next long-term strategy and progress on Epson 25 Renewed

- Improvements to Board operations aimed at strengthening collaboration between the Board of Directors and the executive team

In the future, we will work to further improve effectiveness by addressing these issues.

Responding to Large-Scale Acquisitions of Seiko Epson Shares

The Company's Corporate Governance Policy stipulates the following:

- Whether to accept a bid to purchase a number of shares that would give the acquirer control over the Company's financial and business policies ("large-scale acquisition" hereafter) should ultimately be decided by the shareholders.

- Epson shall ask persons who attempt to make large-scale acquisitions of Company shares to provide a sufficient amount of the information needed to determine the desirability of the large-scale acquisition from the perspective of ensuring and enhancing corporate value and the common interests of shareholders, after which Epson shall disclose the opinions of the Company's Board of Directors regarding the proposed large-scale acquisition, thereby doing its due diligence to provide shareholders with the time and information they need to consider the desirability of the large-scale acquisition. The Company shall also take appropriate actions based on the Financial Instruments and Exchange Act, the Companies Act, and other applicable laws and regulations.