Notice Regarding the Continuation of a Performance-Linked Stock Compensation Plan

Company: Seiko Epson Corporation

Representative: Minoru Usui, President and Representative Director

(Code No.: 6724 First Section, Tokyo Stock Exchange)

- TOKYO, Japan, May 16, 2019 -

The Board of Directors of Seiko Epson Corporation ("the Company") adopted a resolution to continue the performance-linked stock compensation plan ("the Plan") as outlined below. The resolution was adopted at the meeting of the Board of Directors held on May 16, 2019 ("the Board Meeting")

1. Purpose of continuing the Plan

1.1 The Plan, introduced in the 2016 fiscal year, is a transparent and fair way to compensate officers who are eligible for the plan ("Eligible Officers"1) with Company shares based on the Company's financial performance. It is designed to more tightly align the interests of officers with the interests of shareholders and to show a commitment to increasing corporate value over the long term.

The Plan is designed so that number of shares issued to Eligible Officers will fluctuate in accordance with the levels of achievement with respect to medium- and long-term operating performance targets for indicators such as business profit, ROS, and ROE.

1.2 The Plan will employ a framework referred to as the officer compensation BIP (Board Incentive Plan) trust (the "BIP Trust"). Like the performance share plans and restricted stock plans in the U.S., the BIP Trust is a stock-based compensation plan under which Company shares and cash equivalent to the liquidation value of Company shares ("Company Shares, etc.") are issued to Eligible Officers based on considerations such as their position and the level of achievement with respect to operating performance targets.

1.3 At the 74th ordinary general meeting of shareholders held on June 28, 2016 (the "2016 Shareholders' Meeting), the Company approved resolutions on essential conditions, such as the target period (specified in 2.1 below), the maximum amount of cash that can be contributed to the Trust in each period (specified in 2.5 below) and the maximum number of annual points that can be awarded per year (specified in 2.6 below).

With the recent resolution at the Board Meeting, the Company decided to extend the trust period in order to continue the Plan for the three years from the fiscal year ending March 31, 2020 to the fiscal year ending March 31, 2022.

1 "Eligible Officers" means Epson's Directors and Executive Officers who have entered into delegation agreements with Epson, excluding those in positions independent from business execution, such as Outside Directors and Directors who are Audit & Supervisory Committee members, as well as overseas residents.

2. Summary of the Plan

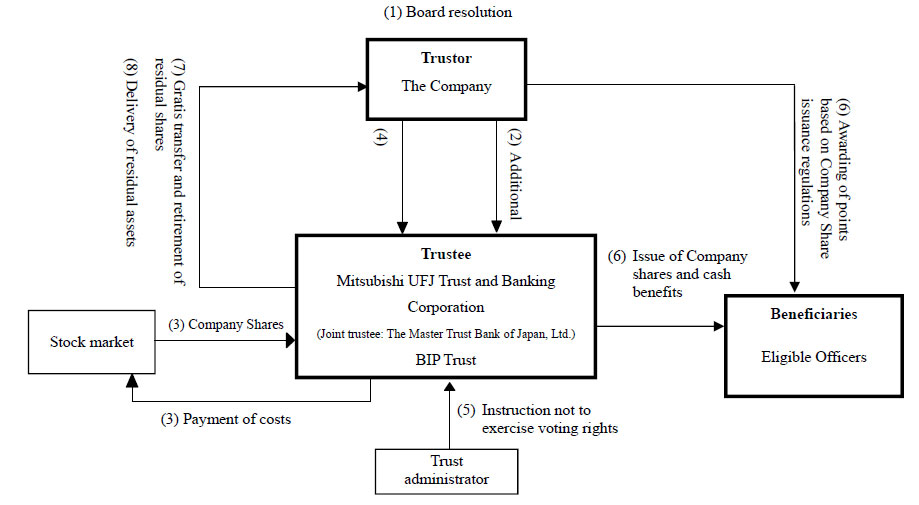

- The Company approves a resolution on the continuation of the Plan at a meeting of the Board of Directors.

- The Company makes an additional contribution to the Trust within the scope approved by resolution at the 2016 Shareholders Meeting and extends the period of the Trust whose beneficiaries are Eligible Officers who satisfy the beneficiary requirements.

- The Trust, acting on the instructions of the trust administrator, acquires Company shares from the stock market, funding the acquisition with cash remaining among trust assets when the Trust agreement is amended and with additional funds contributed to the Trust per (2) above.

- The allocation of surplus funds for Company shares in the Trust is handled in the same manner as for other Company shares and is appropriated for necessary expenses for the Plan.

- Throughout the trust period, voting rights are not to be exercised on Company shares within the Trust.

- During the trust period, Eligible Officers are awarded a specific number of points each year based on their position and other factors, in accordance with the share issuance regulations. The points fluctuate depending on the level of achievement with respect to the Company's mid- and long-term financial performance targets. Furthermore, Company shares, which correspond to a certain proportion of such points, will be issued to Eligible Officers, in principle, after the lapse of three years following the awarding of points. As regards Company shares corresponding to the remaining portion of points, Eligible Officers will receive cash equivalent to the amounts obtained through the conversion of such shares into cash within the Trust as prescribed in the Trust agreement.

- If there are residual shares in the Trust at the expiry of the trust period because, for example, operating performance targets were not met during the trust period, the Company may continue to use the Trust by amending the trust agreement and making an additional contribution to the Trust. Otherwise, the Company will acquire the residual shares, through gratis transfer, and retire them by resolution of the Board of Directors.

- Upon the expiry of the Trust, any assets that remain after allocation to beneficiaries will revert to the Company within the scope of the trust expense reserve after expenses for acquiring shares are deducted from the money in trust. Plans call for the portion exceeding the trust expense reserve to be donated to organization(s) having no interests with Epson and any of its officers.

2.1 Summary of the Plan

The Plan covered the three-year period from the fiscal year ending March 31, 2017 to the fiscal year ending March 31, 2019, but with its continuation, Company Shares, etc. will be issued to Eligible Officers as compensation based on considerations such as their position and the levels of achievement with respect to operating performance targets for each fiscal year for the three years from the fiscal year ending March 31, 2020 to the fiscal year ending March 31, 2022 (the "Target Period")2.

2 If the trust period is extended, the subsequent three fiscal years shall be the Target Period.

2.2 Persons eligible for the Plan (beneficiary requirements)

Company Shares, etc. can be issued from the Trust to Eligible Officers who complete the predetermined procedures for determining eligibility after the lapse of three years following the awarding of basic points, provided that the Eligible Officers meet the beneficiary requirements. The number of Company Shares, etc. issued will correspond to the number of points [as specified in (4) below].

The beneficiary requirements are as follows:

(1) Must be an Eligible Officer during the Target Period (including persons who become an Eligible Officer for the first time during the Target Period);

(2) Must not have retired as a result of a disciplinary dismissal and must not have engaged in certain illegal activities while in office;

(3) The number of points specified in (4) below has been determined; and

(4) Any other requirements necessary to achieve the purpose of the Plan as a stock compensation plan.

Note: If an Eligible Officer is to retire or be transferred overseas, Company Shares, etc. will be issued to the Eligible Officer when that decision is made.

2.3 Trust period

The trust period shall be approximately three years from August 1, 2019 (planned) to August 31, 2022 (planned). The Trust may be extended at the expiry of the trust period by amending the trust agreement and contributing additional money to the Trust. In this case, the trust period shall be extended for a length of time equivalent to the initial trust period, and the Company shall contribute additional money to the Trust up to the maximum amount approved by a resolution at the Shareholders Meeting for each extended trust period. Points will continue to be awarded to Eligible Officers during the extended trust period.

2.4 Number of shares issued to Eligible Officers

Under the Plan, the basic points are awarded in accordance with Eligible Officer position and other factors every year in July during the trust period. The number of points fluctuates because the basic points are multiplied by a performance-based coefficient, which reflects the levels of achievement of the mid- to long-term operating performance targets such as the Company's business profit, ROS and ROE. In this scheme, one point is equivalent to one Epson share. However, if it is recognized that the number of points needs to be adjusted to ensure fairness due to a stock split or a reverse stock split during the trust period, the number of points shall be adjusted in proportion to the ratio of the stock split or reverse stock split. In addition, Company Shares, etc. will be issued to Eligible Officers in a number corresponding to the number of points after the performance coefficient is multiplied, in principle, after the lapse of three years from the date on which the basic points were awarded.

2.5 Maximum amount and planned amount of money to be contributed to the Trust

The maximum amount that the Company can contribute to the Trust during each Target Period is 500 million yen, as approved by resolution at the 2016 Shareholders Meeting. The maximum amount of money in the Trust is equal to the sum of funds for acquiring shares during the Target Period and trust fees and expenses. The amount is derived by taking into account factors such as future revisions to compensation levels and the compensation composition ratio, the increase in the number of Eligible Officers and the possibility of fluctuations in stock value.

The Company plans to make an additional contribution of approximately 220 million yen to the Trust.

2.6 Maximum number of points awarded to Eligible Officers

The maximum number of annual total points that can be awarded to Eligible Officers (the maximum is calculated by multiplying the total number of annual basic points that can be awarded to Eligible Officers by the maximum performance coefficient) is 100,000 points, as approved by resolution at the 2016 Shareholders Meeting.

2.7 Method by which the Trust acquires Company shares

The Trust, acting on the instructions of the trust administrator, acquires up to 300,000 Company shares for each Target Period from the Company (disposal of treasure shares) or from the stock market, funding the acquisition with cash remaining among trust assets when the Trust agreement is amended and with additional funds contributed to the Trust.

The Trust plans to acquire Company shares from the stock market up to the amount allowed by the funds for acquiring shares specified in 2.5 above and up to the maximum number of shares that can be acquired.

Furthermore, if, during the trust period, the number of shares in the Trust could fall below the number needed to cover the number of points awarded to Eligible Officers due to an increase in the number of Eligible Officers or otherwise during the trust period, additional money may be contributed to the Trust to acquire additional Company shares. The contribution shall not cause the cash in trust to exceed the maximum approved at the Shareholders Meeting, nor shall the number of shares acquired exceed the maximum approved at the Shareholders Meeting.

2.8 Method and timing of the issue of Company Shares, etc. to Eligible Officers

Eligible Officers who complete the predetermined procedures for determining eligibility will receive 50% of their Company Shares, etc. (rounded down to the nearest share unit) in an amount corresponding to their point totals after multiplication with the performance coefficient. As a general rule, the Trust will issue Company Shares after the lapse of three years from the date on which the basic points were awarded. For the remaining portion of Company Shares, the cash equivalent to the amounts obtained through the conversion of the shares into cash within the Trust shall be issued to Eligible Officers.

If an Eligible Officer retires during the trust period, the Eligible Officer can, in principle, receive Company Shares, etc. in an amount corresponding to the number of accumulated points held at that point. Meanwhile, if an Eligible Officer passes away during the trust period, the Eligible Officer's heir shall, in principle, receive a monetary amount that is equal to the amount obtained by converting Company shares into cash within the Trust, the number of Company shares depending on the number of accumulated points held by the Eligible Officer at that point.

2.9 Exercise of voting rights for Company shares in the Trust

To ensure the neutrality of the Company's management, voting rights for the Company shares in the Trust (namely, the Company shares prior to their issue to Eligible Officers in accordance with 2.4 above) shall not be exercised during the trust period.

2.10 Handling of surplus dividends relating to Company shares in the Trust

Surplus dividends relating to the Company shares in the Trust will be received by the Trust and appropriated to its trust fees and expenses. Plans call for any residual assets upon the final termination of the Trust to be donated to an organization(s) with which the Company and the Company's officers having no material interests (i.e., a material business or professional relationship).

2.11 Handling of residual shares at the termination of the Trust

If there are residual shares at the termination of the Trust because, for example, operating performance targets were not met, the Company plans to acquire these residual shares at such time through gratis transfer and cancel them by resolution of the Board of Directors as a measure for returning profits to shareholders.

(Reference) Overview of the trust agreement after continuation (planned)

| 1) Type of trust | Monetary trust other than a designated individually operated monetary trust (third-party benefit trust) |

| 2) Purpose of trust | Provide incentives to Eligible Officers |

| 3) Trustor | The Company |

| 4) Trustee | Mitsubishi UFJ Trust and Banking Corporation (Joint trustee: The Master Trust Bank of Japan, Ltd.) |

| 5) Beneficiaries | Eligible Officers who meet the beneficiary requirements |

| 6) Trust administrator | An independent specialist who does not have an "interest" in the Company (i.e., a material business or professional relationship) |

| 7) Date of trust agreement | August 2, 2016 (with amendment planned for August 1, 2019) |

| 8) Trust period | August 2, 2016 through August 31, 2019 (with plans to amend and extend the trust agreement to August 31, 2022) |

| 9) Plan launch date | October 1, 2016 |

| 10) Exercise of voting rights | Voting rights not be exercised |

| 11) Class of shares to be acquired | Common stock of the Company |

| 12) Planned amount of additional contribution to the trust | 220 million yen (including trust fees and expenses) |

| 13) Maximum amount of money in trust | 500 million yen (including trust fees and expenses) |

| 14) Method of acquiring shares | Acquisition from the stock market |

| 15) Period during which shares will be acquired | November 1, 2019 through November 29, 2019 |

| 16) Holder of vested rights | The Company |

| 17) Residual assets | Residual assets that the Company may receive as the holder of vested rights within the scope of the trust expense reserve after expenses for acquiring shares are deducted from the money in trust. |

Content of trust/stock related business

| 1) Trust-related business | Mitsubishi UFJ Trust and Banking Corporation and The Master Trust Bank of Japan, Ltd. will handle the trust-related business as trustees of the BIP Trust. |

| 2) Stock-related business | Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. will handle the business related to the issue of Epson shares to the beneficiaries in accordance with a business consignment agreement. |

About Epson

Epson is a global technology leader dedicated to becoming indispensable to society by connecting people, things and information with its original efficient, compact and precision technologies. The company is focused on driving innovations and exceeding customer expectations in inkjet, visual communications, wearables and robotics. Epson is proud of its contributions to realizing a sustainable society and its ongoing efforts to realizing the United Nations' Sustainable Development Goals.

Led by the Japan-based Seiko Epson Corporation, the worldwide Epson Group generates annual sales of more than US$10 billion.

corporate.epson/en/